Plus how to get a piece of music royalties.

NFTs are the newest fad in the world of e-commerce and business, and have moved into the world of music. Musicians like Kings of Leon, Jay Z, Aphex Twin and Steve Aoki have all recently dived into the world of NFTs, but with their complicated structure and high cost to the environment, are they a way of the future, or just a fad?

NFTs (Non-Fungible Tokens) are essentially unique, exchangeable digital items that are saved on a digital ledger which provides a proof of purchase, similar to an authenticity certificate. As they are deployed on large scale global networks such as Ethereum, counterfeiting these certificates is almost impossible.

Read up on all the latest interviews, features and columns here.

In recent years, they’ve invaded all types of media – Art, Games, and even memes, changing all the rules around ownership and copyright. As of July 2021, NFT sales are sitting over $2 billion.

They’ve slowly been seeping their way into the music world too, with artists creating music, artwork, or any form of digital media, chucking it on a digital ledger, and enabling fans can buy it using cryptocurrency, which is usually Ethereum because of its smart contract infrastructure.

Now, the hard and fast truth about this is purchasing an NFT means you own that specific piece of work but doesn’t provide you with permission to replicate of the work. A common example used to explain this is, much like the Mona Lisa, there are millions of print copies available and owning an NFT is like owning the original painting, or a signed numbered limited edition print of it.

Since the first NFT came into the world only a couple of years ago, a number of bands and artists have dived into the area, most notably Kings of Leon, who released their latest album, When You See Yourself, as an NFT.

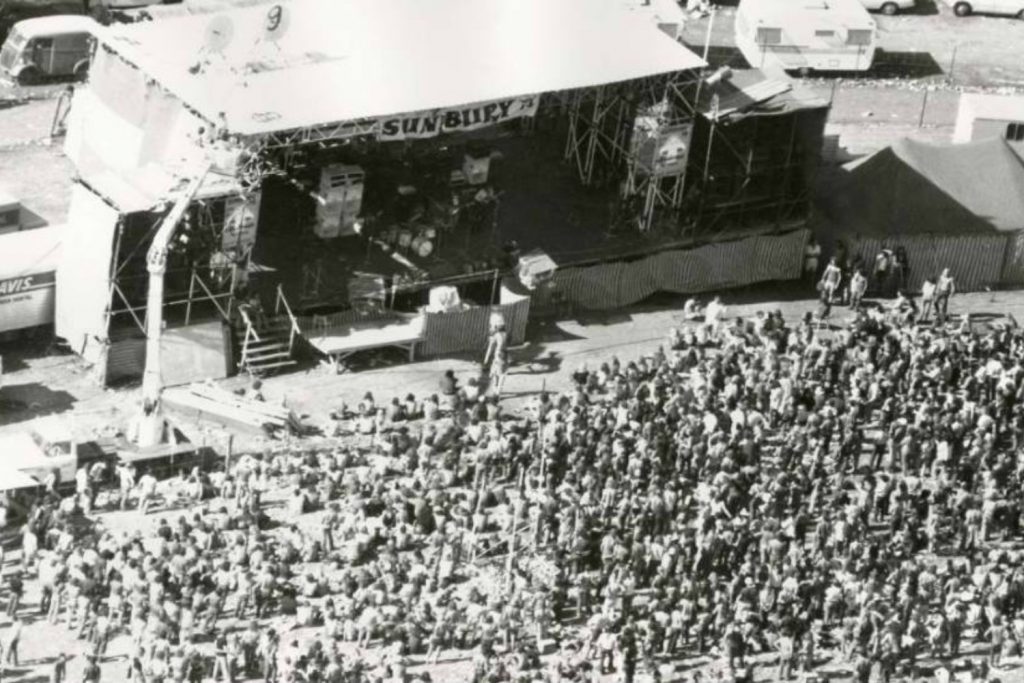

Fans could buy a token for $50, which entitled them to a limited edition vinyl record shipped to their house, an MP3 download of the album, and a rare artwork. The latter working like a form of digital merchandise.

Fans flocked to Crypto site YellowHeart in droves to go through the drawn out process of purchasing Kings of Leon NFTs, which required a Metamask account, Ethereum, and creating a YellowHeart account.

Along with the reasonably priced tokens, Kings of Leon also minted (created an NFT of) 18 ‘golden tickets’, which entitles owners to four front row tickets to a concert of each Kings of Leon tour, for life. Also included is a driver to the show, meeting the band and every single merch item on sale that day. Talk about an ultimate experience.

Utilising smart contracts, allows these NFTs to pay a percentage of each sale back to the original creator, which in this case is the band, who in turn are donating to a charity supporting out of work touring crews. This ensures that if it sells for an exorbitant amount of money, the original creator will see a percentage of it with every changing of hands, a safety net for an artist who doesn’t understand the value of their work when first sold.

Kings of Leon earned $2 million from the two weeks of NFT sales alone. To put that into context, one song on the album would need roughly 400,000,000 streams on Spotify to earn that, if the band had full ownership of the recording.

But as is the case with anything out there in the world of e-finance, NFTs have a lot of disadvantages, too. There’s an immense environmental impact associated with the tokens. Simply put, the amount of computing needed to purchase NFTs create an absurd amount of carbon emissions.

This is due to NFTs operating on proof of work networks that require immense computing power to solve complex cryptography problems. A recent piece on Wired has stated that the minting or sale of an NFT can emit the same amount of emissions as 2 graphics studios operating over a full year.

This recently stopped UK group Glass Animals from their journey into the NFT world. After announcing that an NFT would be part of the VIP pack for a US tour, they were met with backlash from fans.

Some business-minded musicians have leveraged this to their advantage, and have allocated a number of their funds from NFT sales to reverse the impacts of the emissions and climate change in general.

Canadian vocalist Grimes recently dropping art NFTs, where a bunch of the proceeds went to carbon removal, and British DJ Aphex Twin donating a portion of sales to building ecosystems and planting trees.

🗡️The “War Nymph” collection is dropping tomorrow, February 28 @ 2pm EST.

Are you ready for this collaboration between @Grimezsz & @MacBoucher1? Who is excited for this drop? 👀👀👀

Don’t forget a % of the proceeds from the #NFT sales will be donated to @carbon_180! pic.twitter.com/Z07WTvrM6g

— Nifty Gateway (@niftygateway) February 27, 2021

When dealing with NFTs, a number of questions arise, most notably around the idea of ownership – if a buyer of a token is gaining ownership, what does it mean for royalties and copyrights?

The world of publishing and royalties have always been a contentious area for musicians and labels alike, with an extraordinary amount of lawsuits between corporations and musicians occurring for years.

When a band or artist is signed to a major label and releases a song, there are two forms of copyright and royalty agreements associated with it – one in regards to the songwriting and one in regard to the production.

Usually, as publishers maintain and work out these royalty deals, bands are left with limited revenue from streams and fees associated with the songs they write. Many split 50/50, but there have been a number of musicians only taking home 20% – 30% of total revenue or less, with the rest split between publishers, labels and other necessary staff.

But NFTs are set to change all that for better, they’ve truly shaken up the landscape, and are slowly helping get artists the money they deserve. When setting up an album as an NFT, bands can set up percentages, so the band receive a small percentage of every token resale, which unlike when a vinyl record is resold, money actually goes to the artists.

In regards to customers getting a piece of the royalty pie, Bandroyalty is one of the few platforms around that allow for staking of their limited edition NFTs to earn royalties when songs are played. They own a catalog of 50 songs including Mirrors by Justin Timberlake, which currently has over 900 million plays on Youtube alone.

Purchasing an NFT through their platform and holding onto it (staking it), gives you access to these royalties from that moment on. As apposed to NFTs consisting of just music, these will actually earn you money, although it might not be loads as there are 3000 NFTs which will share in 50% revenue.

Music NFTs are speculative assets, which provide an avenue for direct financial support for an artist in exchange for a unique digital asset which can be bundled with both digital and physical products. NFT technology is still very much in its infancy, and has growing pains in regards to climate impact and the sheer quantity of average quality tokens minted every minute.

A large majority of current music consumers may not see the benefits of the system, which is fine, as there is always streaming services available to access music. There is a wide world of possibility available through smart contracts in the music industry which include capping ticket resale prices and verifying ownership of physical products (say musical instruments) through un-hackable services.

With further growth in the sector, hopefully there will arise solutions that don’t create immense carbon emissions and allow musicians to take control of how their work is distributed digitally.

Read more about NFTs on the Ethereum website.